How to determine your schedule

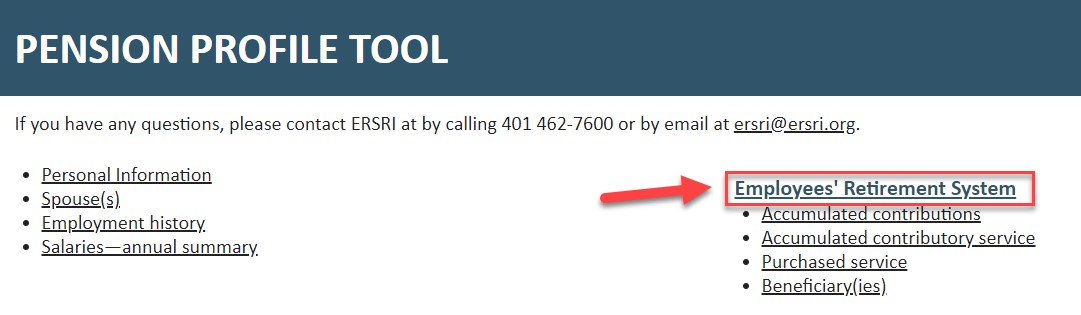

You can verify your schedule on the ERSRI Member Portal. Simply login, click “View My Pension Profile,” then scroll down to the Membership Information Panel or click the “Employees’ Retirement System” hyperlink. Your schedule is listed in the field entitled “Group.”