Retiree resources

Set up your account profile

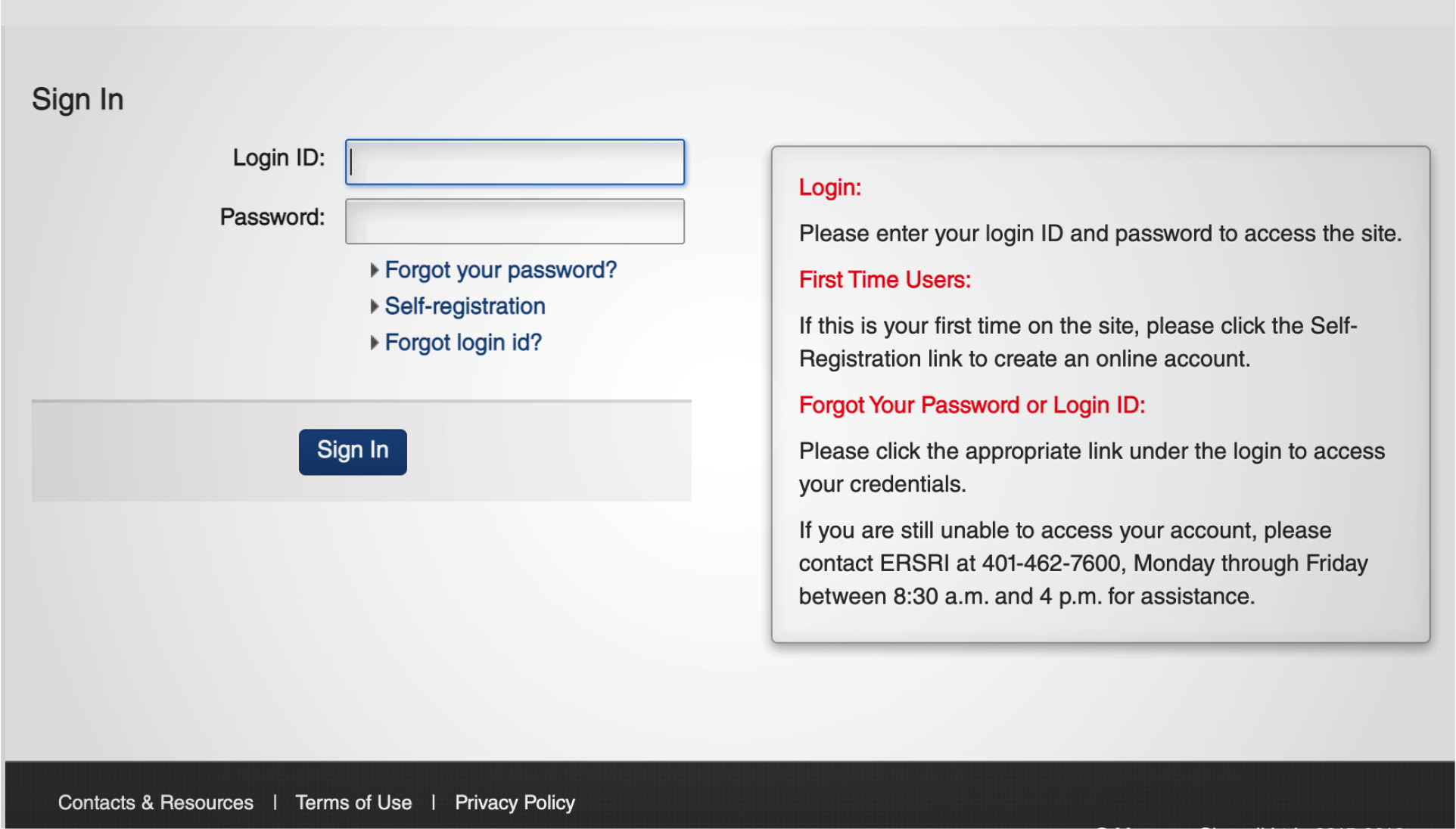

Register to access your ERSRI account and login to our secure Member Portal where you can login 24/7 to update your address and contact information, view your pay stubs, submit tax changes, view and print your 1099-R, and more.